Loan Syndication Process Diagram

A syndicated loan is a commercial loan provided by a group of lenders and structured arranged and administered by. Borrowers may also be adversely affected by syndicated loan agreements.

Structure development and implications1 the syndicated loan market allows a more efficient geographical and institutional sharing of risk.

Loan syndication process diagram. It is a key source of financing for many large and middle market companies in. If the problem arises it may be difficult for borrowers to satisfy all banks at the same time. Loan syndication financial institutions.

Disadvantages of loan syndication. In effect the syndication market completes a continuum between traditional private bilateral bank loans and publicly traded bond market. A syndicated loan also known as a syndicated bank facility is a loan offered by a group of lenders referred to as a syndicate that work together to provide funds for a.

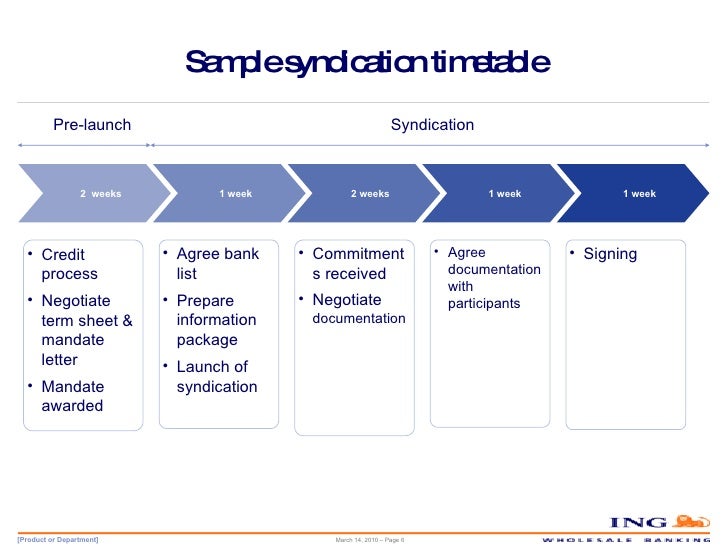

Features of loan syndication 9 6. Syndicated loans provide borrowers with a more complete menu of financing options. Parties and their role within the syndication process 19 11.

Stage in the loan syndication process 11 7. Introduction to loan syndication 5 5. The process of syndication starts with an invitation for bids from the borrower.

Corporate loan market is a vital source of capital for american business according to government data the us. Euro area banks have expanded pan. A syndicated loan primer.

The syndicated loan market. Time consuming process since negotiating with the bank can take various days thus loan syndication is a time consuming process. Loan syndication process diagram.

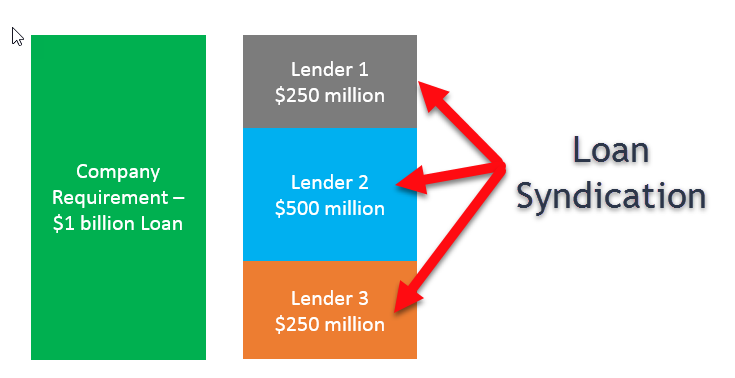

As a syndicated loan is a collection of bilateral loans between a borrower and several banks the structure of the transaction is to isolate each banks interest whilst maximising the collective efficiency of monitoring and enforcement of a single lender. Loan syndication is the process of involving several different lenders in providing various portions of a loan. Loan syndication most often occurs in situations where a borrower requires a large.

Project finance and loan syndication 16 10. Syndicated loans are loans offered by a banking group that are organized by one or more banks. Large us and european banks originate loans for emerging market borrowers and allocate them to local banks.

Reasonspurpose for syndicated lending 13 8. Syndicated loan market totals roughly 25 trillion of committed lines and outstanding loans the committed lines are loans in the form of revolvers they can be drawn repaid drawn repaid etc. Stroke pushed the loan syndication process at least in the leveraged arena across the rubicon to a full fledged capital markets exercise.

Advantages of syndicated lending 14 9. Large us and european banks originate loans for emerging market borrowers and allocate them to local banks.

Eu Loan Syndication On Competition And Its Impact In Credit

Eu Loan Syndication On Competition And Its Impact In Credit

Fas 157 Term B Syndicated Loans Fair Value Disclosure

Fas 157 Term B Syndicated Loans Fair Value Disclosure

Fas 157 Term B Syndicated Loans Fair Value Disclosure

Fas 157 Term B Syndicated Loans Fair Value Disclosure

Presentation Of Syndicated Loans

Ares Our Business Credit Targeted Investments

Ares Our Business Credit Targeted Investments

Loan Syndication Process Diagram Atkinsjewelry

Loan Syndication Process Diagram Atkinsjewelry

German Firm Durr Secures 750m Syndicated Loan Via

German Firm Durr Secures 750m Syndicated Loan Via

Loan Syndication Meaning Process How Loan Syndication

Loan Syndication Meaning Process How Loan Syndication

Lma Real Estate Finance Documentation Update Publications

Islamic Syndicated Financing An Underdeveloped Method Of

What Is Loan Syndication Process

Feds 2018 085 The U S Syndicated Loan Market Matching

Feds 2018 085 The U S Syndicated Loan Market Matching

Loan Syndication By Ca Dhruv Agrawal

Loan Syndication By Ca Dhruv Agrawal

Syndicated Loan Fpml Requirements

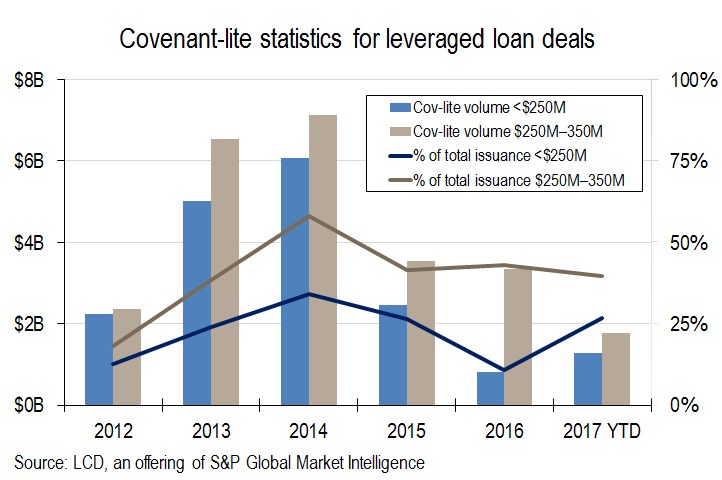

Leveraged Loans Covenant Lite Structure Gains Ground In

Leveraged Loans Covenant Lite Structure Gains Ground In

Financial Services Syndicated Loans Sumitomo Mitsui

Financial Services Syndicated Loans Sumitomo Mitsui

Belum ada Komentar untuk "Loan Syndication Process Diagram"

Posting Komentar